We use cookies to enhance your browsing experience. By clicking "Accept", you consent to our use of cookies. Read More.

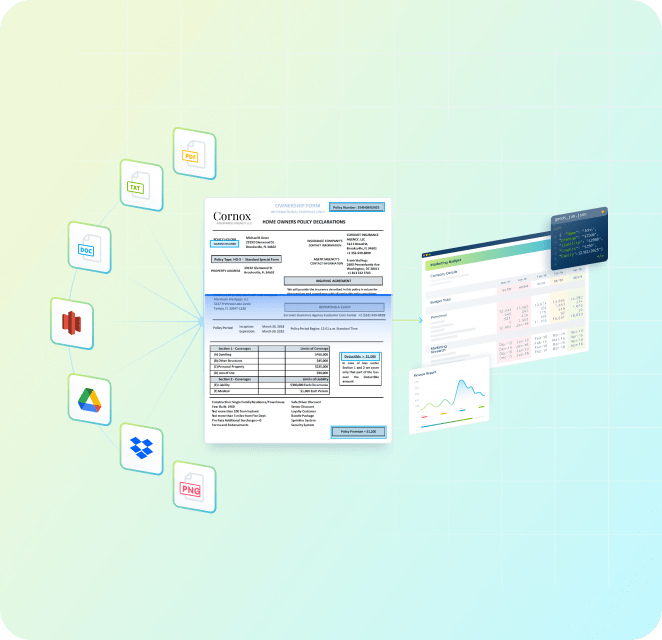

Pull all your documents

Turn every document into a data stream. Point Unstract to your existing storage—S3, Google Drive, Dropbox, or data lakes. No migration needed. Support for 50+ formats and types including PDFs, images, Excel, and even handwritten forms.

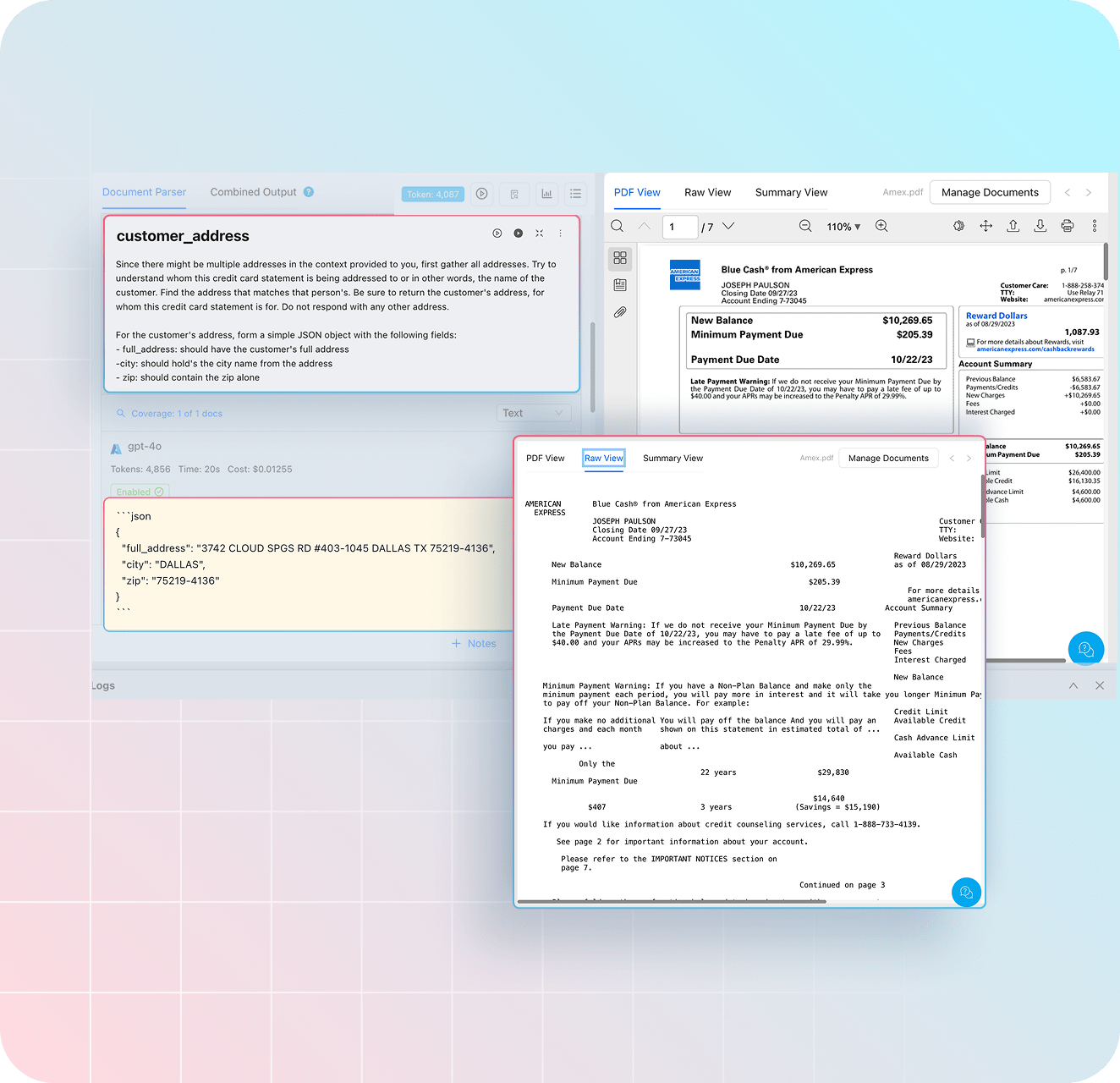

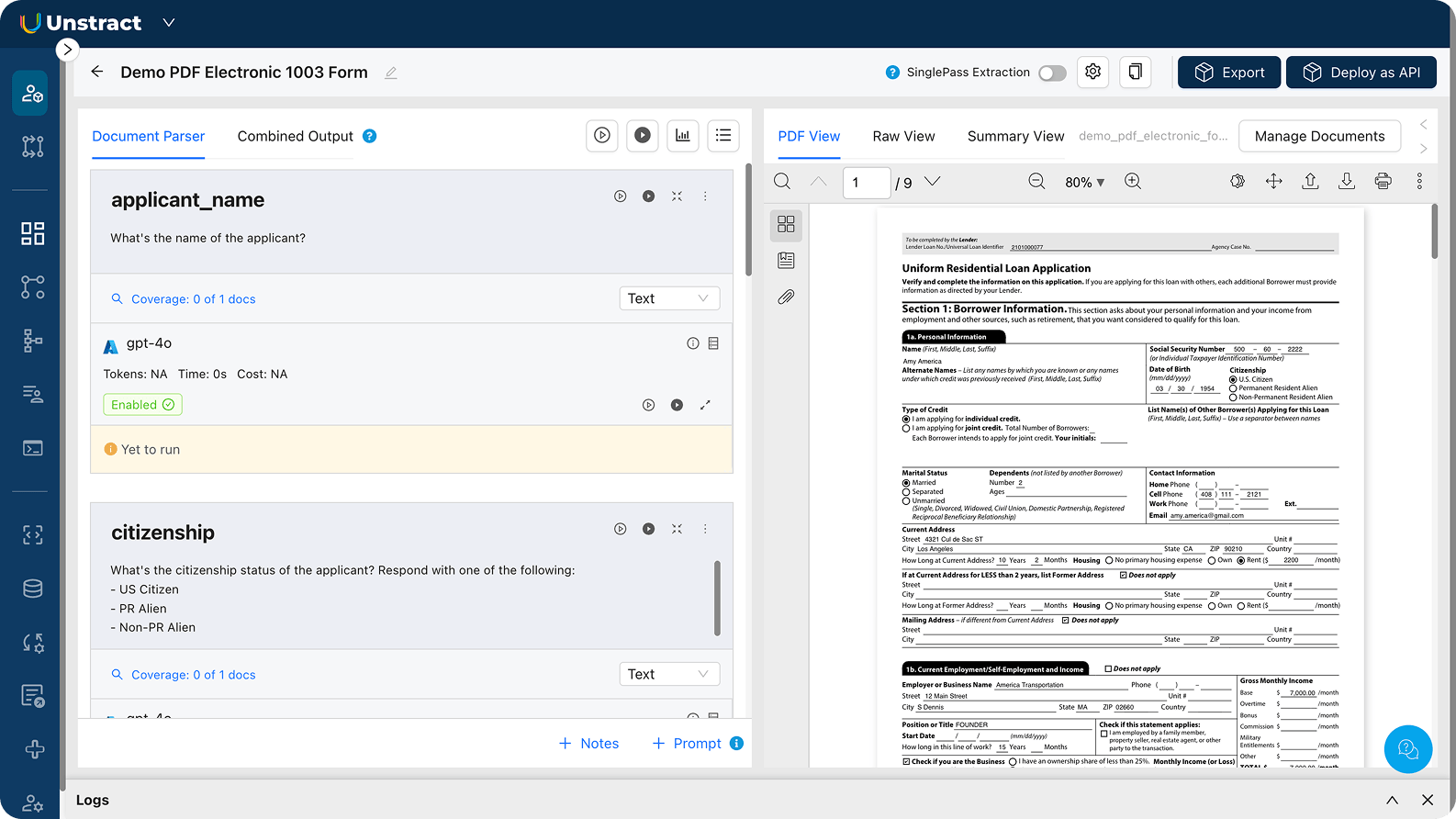

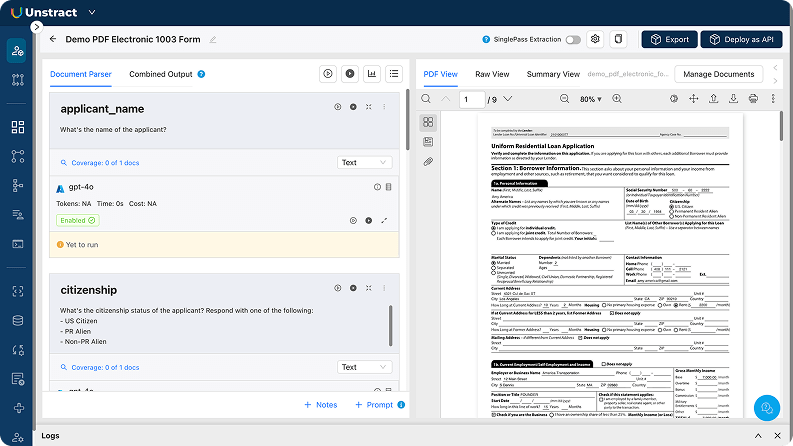

Define what you want to extract

Use the no-code Prompt Studio to tell Unstract exactly what to extract. LLMWhisperer, the built-in text extractor, extracts data from any financial document with 99% accuracy.